By: Marek Grzybowski

The European offshore wind market is diverse: for a long time, a pioneering team made up of Denmark, the UK, Belgium, the Netherlands, and Germany has been dominating the scene. 80 % of the global offshore wind resource potential is located in deep water – i.e. too deep to explore with conventional bottom-fixed turbines.

Many countries have not been able to explore their offshore wind potential due to the water depth of their coastlines. This is where the recent innovations in floating foundations come into the game.

An exclusive interview for eBlue Economy with Karina (Brenner) Würtz, Geschäftsführer, Stiftung OFFSHORE-WINDENERGIE, General Manager, RWE Renewables

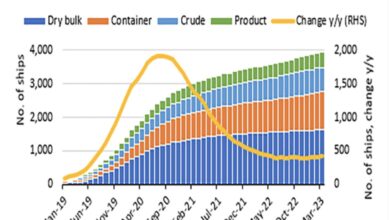

Marek Grzybowski: The offshore wind energy sector will again exceed 10 GW of installations in 2022, after the first exceedance of this amount for the first time last year, experts forecast.

Annual onshore wind installations in Europe, the Middle East, and Africa will surpass all previous years with developers commissioning 22GW of projects, 3GW higher than the previous record set last year – Bloomberg forecast. Great Britain, Denmark, and Germany are mature markets. Sweden, Finland, Poland, Spain, France, Italy, and Turkey are emerging markets. They are on the way to exceeding 1GW in annual installations. How will you describe the European market?

Karina Würtz: You are right, the European offshore wind market is diverse: for a long time, a pioneering team made up of Denmark, the UK, Belgium, the Netherlands, and Germany has been dominating the scene. With the rising importance of national carbon reduction goals, other European countries have established their own offshore wind installation targets. including Poland and Baltics

The Russian war in Ukraine could provide the ultimate push towards renewable energy resources, as it is undoubtedly displayed. So I expect installation targets to be increased even faster in the near future.

On the regulatory side, however, European countries provide a plethora of different regulation frames in literally each and every aspect of offshore wind regulation, being it in terms of grid connection, certification, auctioning systems, local content requirements, governmental subsidies, or environmental protection.

This increases the costs for European operators and hence, ultimately, the cost of renewable electricity. On the European and national levels, every effort must now be made to shorten approval procedures, increase public acceptance and standardize regulatory frameworks as much as possible.

Marek Grzybowski: Mergers and acquisitions have made the market of wind turbine producers oligopolistic. Oil and gas companies become larger players in the offshore wind market

They are operating under pressure from Chinese producers who offer installations half cheaper than producers from Europe and the United States. Will European and US producers defend themselves against Chinese production?

Karina Würtz: European manufacturers are responsible for the engineering of the very vast majority of turbines in European waters (although not all components have been produced in Europe )

GE has successfully entered the European offshore market with installations in windfarms like Merkur Offshore (in the German North Sea) and will certainly have a strong position in the US American offshore sector. Experienced operators of offshore windfarms know a thing or two about the importance of component quality, turbine performance, contractual warranties, and the quality of servic

In particular, successful turbine manufacturers operate with a strong local service backbone in order to minimize turbine standstills and optimize performance.

This is a substantial aspect of each turbine tender and Chinese manufacturers struggle to enter a market where the quality of timely service is so vitally important. However, once they manage this challenge, they could provide a strong competition to challenge, they could provide strong competition to established western manufactures

Nevertheless, the Russian war in Ukraine underlines the importance of resilience in supply chains, in particular in such a vital sector as offshore Wind

Marek Grzybowski: Floating wind installations in Scotland, France California and other regions attract millions of new investment. Today, the floating wind market is relatively nascent. What are your outlooks. Will the global accumulated offshore capacity continue to grow? What will these quick changes be? How will the installed capacity grow?

Karina Würtz: 80 % of the global offshore wind resource potential is located in deep water – i.e. too deep to explore with conventional bottom-fixed turbines. Many countries have not been able to explore their offshore wind potential due to the water depth of the coastlines

This is where the recent innovations floating foundations come into the game

Their importance cannot be overestimated; I am convinced that floating offshore wind farms will see a constant acceleration over the next decade.DNV forecasts the global growth of the technology to be more than 264 GW in 2050. The European Union has a large untapped potential in areas with more than 100 meters of ocean depth. In Germany, we do not expect much movement toward floating wind turbines due to the shallow seas.