A few months after the COVID-19 pandemic began in 2020; the world soon realized the enormous impact that the health crisis would have on the global economy, especially on sectors such as logistics & port activity, engine -until before the emergence of the Coronavirus – of the seething and endless exchange of goods between countries.

After only ten weeks of COVID outbreaks in different countries throughout the world, the consulting firm Deloitte (based on the impacts of the virus in China and Asia) anticipated that production would be affected, the logistics chain would suffer disruptions and the financial system would be beaten.

Meanwhile, in June, the World Bank published the report “World Economic Prospects”, in which the ante was upped and “the worst recession since World War II” was announced, highlighting that such a significant drop in so many economies simultaneously has not been experienced since 1870.

CURRENT LANDSCAPE

As anticipated, after more than two years since the disease that changed the world began, the effects continue to deepen. Health uncertainty is still high: on the one hand, the rise of the Omicron variant while foreign trade between countries was resuming its usual flows; on the other hand, new and violent COVID-19 outbreaks since March, such as the one that occurred in China.

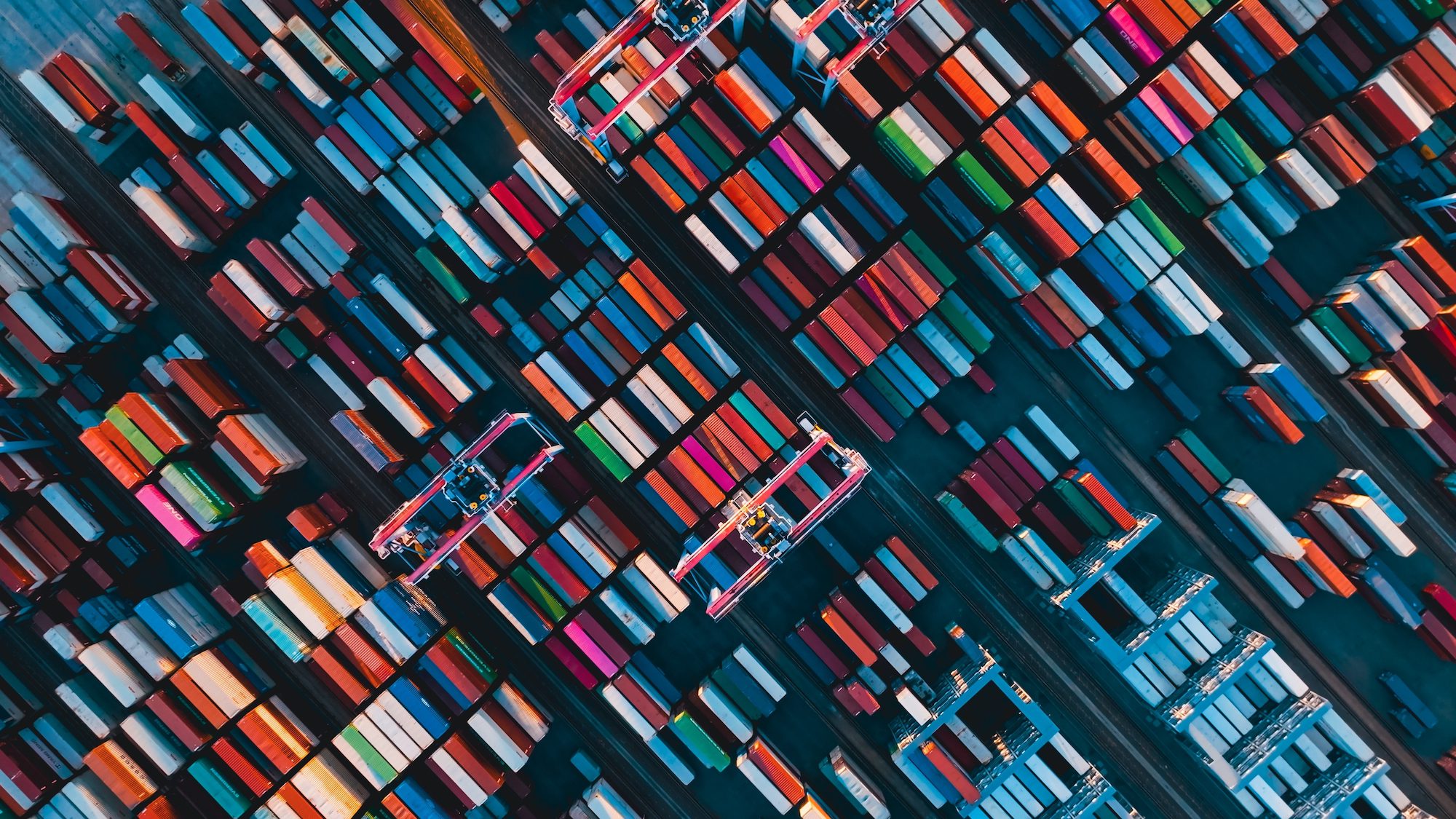

Once again, the progress in resolving the great bottleneck in trade flows was reversed and, as expected in any global chain, has affected ports throughout the continent as well.

The port of Shanghai’s closure due to COVID-19 confinement and the long line of bulk carriers and container ships that waited weeks to enter or leave its terminals (which was known as the “Great Jam”), led to a “domino” effect on other maritime poles. Experts estimated that up to 20% of the world’s container ship fleet was stuck in some port, including some Latin American points.

To make things even worse, the recent detection of “monkeypox” infection cases, also of zoonotic origin, in Europe, Oceania, and the United States last May, increased health authorities’ concerns and fueled the ghost of a new large-scale lockdown.

Not to mention the Russian-Ukrainian conflict that threatens the lasting European peace for the first time since the end of the Second World War, adding vulnerability factors to the financial systems and to the global exchange of goods and services.

Naturally, by putting pressure on certain key commodities in the nations involved, affecting the formation of shipping routes, and increasing the value of maritime freight, its potential effects continue to be analyzed.

By the end of February, before the war started, referents of the sector -such as Kuehne + Nagel- had warned about “hot spots” in terms of goods flow congestions in ports such as Shanghai, Rotterdam, New York, Hong Kong, Long Beach, and Ningbo, among others.

Other studies, in particular a Flexport report, ensured that the average time on the Asia-Europe route has doubled, going from 55 to 108 days in some cases, increasing up to 11% the possibility of having delays in container delivery. This figure during the “Great Jam” was even higher.

But this does not end here. The climatic urgency caused by global warming has also become a complex issue for the port sector. A recent study released by the United States National Center for Atmospheric Research (NCAR) in 2021 estimates that, by the year 2100, 2.013 port infrastructures could see their operations affected for climatic reasons.

If greenhouse gas emissions do not begin to decrease, climatic factors such as rainfall, wind changes, rising waves, and sea level, in addition to the frequency and intensity of hurricanes, would have a high negative impact on port activity, particularly on 289 ports at “extreme” risk, including some in the Caribbean and in the United States.

WHAT IS COMING FOR THE REGION?

This scenario of volatility and high uncertainty has affected the economic activity in our region. As a result of the health crisis and the Ukrainian conflict, with the inflationary consequences and the financial vulnerability they imply, by the end of April, the Economic Commission for Latin America and the Caribbean (ECLAC) reviewed the average growth projections for Latin-American countries to 1.8%.

However, the uncertainty did not reach the investment agenda at the Latin American level. In port & logistics terms, several key investments will continue during this year and the following ones, thus improving the continent competitiveness to face the challenges that the future recovery of economic activity, through the promotion of innovation, technology and infrastructure will entail.

On the other hand, the new episodes of tension in the supply chains -from the Great Congestion in China to the closures in Russia- have also made the United States and Europe look toward Latin American countries as potential partners for “friend-shoring”, which is the strategy based on diversifying production and marketing by co-producing key products. For example, countries like Honduras, Guatemala, and El Salvador were mentioned as potential strategic partners in the textile production by experts quoted by the BBC.

Caution, patience, and trust seem to be the recipe for Latin America during 2022. After the great debacle of 2020 and some signs of recovery last year, this year will face a complex cycle -including an economy that will slow the growth rate globally, greater restrictions that will be implemented, and the products value increase- as stated by Daniel Titelman, Director of ECLAC’s Economic Development Division.