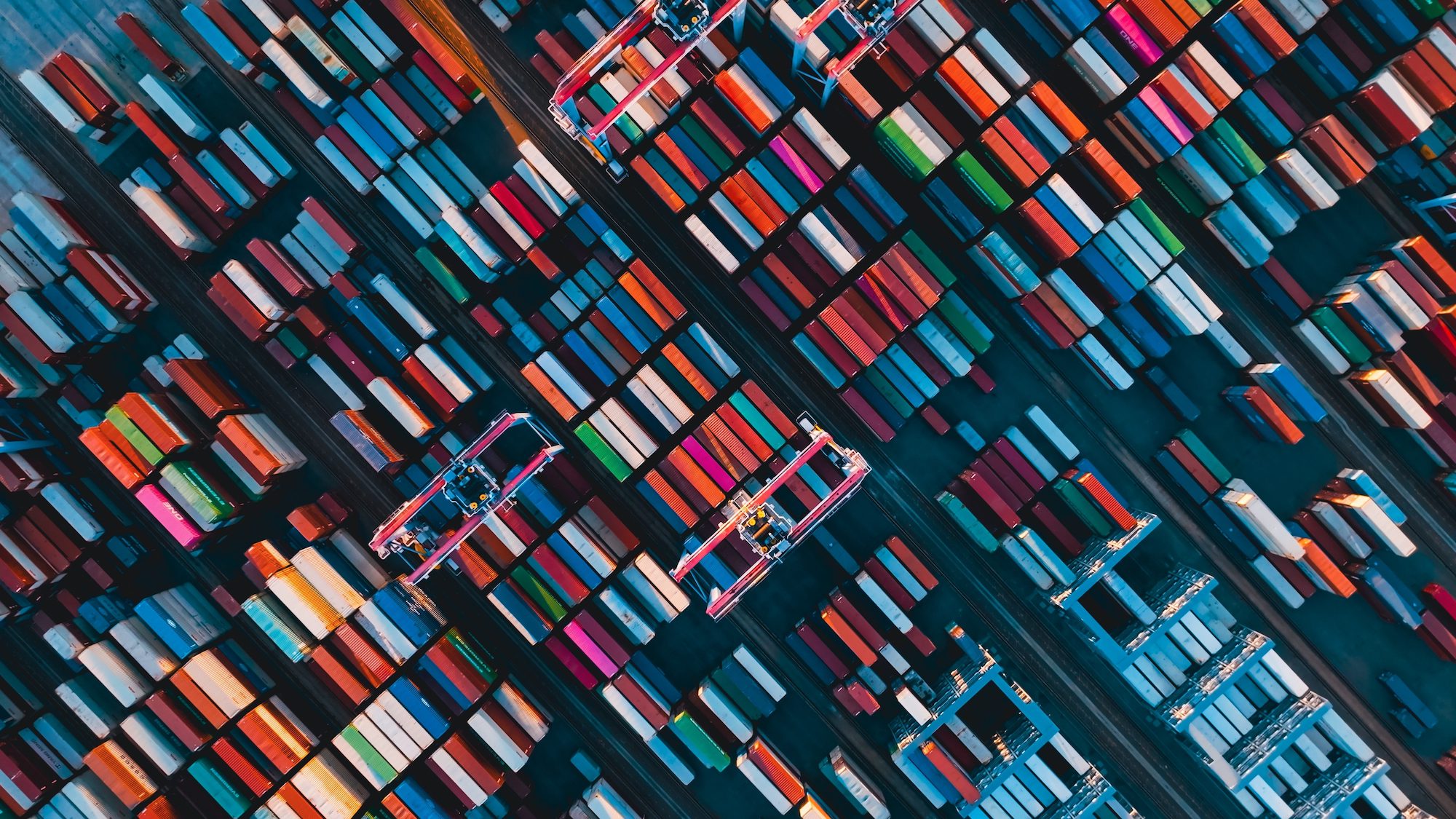

HPPL operates five container terminals in strategic locations, including Mumbai, Mundra, Chennai, and Cochin.

DP World and India’s National Investment and Infrastructure Fund (NIIF) have announced the broadening of their existing partnership, with NIIF Master Fund investing primary capital of INR 22.5 billion[1] (approximately US$300 million) for a shareholding of approximately 22.5% in Hindustan Ports Private Limited (HPPL), the wholly-owned subsidiary of DP World.

With this transaction, which is also the Master Fund’s single largest investment, NIIF’s investment under this partnership will reach around US$500 million. The transaction is subject to customary completion conditions and is expected to close by Q1 CY2023.

HPPL is one of India’s leading container terminal platforms with a proven track record of growth over the long term. The entity operates five container terminals managing more than 5 million TEU[2] of capacity and representing a national market share of over 20%. The terminals are in strategic growth locations including Mumbai (2), Mundra, Chennai, and Cochin.

This investment from NIIF Master Fund extends the existing DP World and NIIF partnership, formed through the creation of Hindustan Infralog Private Limited (HIPL) in 2018. Since its inception, HIPL has made substantial investments in rail logistics, multi-modal logistics parks, container freight stations, economic zones, cold chain infrastructure, and contract logistics to create a market-leading integrated logistics platform.

As the value chain becomes more integrated, significant growth opportunities exist across the entire Indian ports and logistics space, and both HIPL and HPPL are suitably placed to capture these opportunities.

The primary capital raised through this transaction will aid in new infrastructure development, drive supply chain efficiencies and support future growth initiatives of HPPL.

The investment in this combined entity will improve cargo connectivity which will deliver cost efficiencies and an enhanced customer experience.

Sultan Ahmed Bin Sulayem, Group Chairman and CEO of DP World, said: “The broadening of our partnership with NIIF to include our flagship India ports platform is a natural extension of our existing relationship and aligns both parties to focus on delivering end-to-end supply chain solutions.

Since the beginning of this partnership with NIIF, we have made significant progress in building an inland logistics infrastructure network of great scale that complements our container ports platform.

Notably, the opportunity landscape in India remains significant and this transaction will allow us to accelerate investment across ports and logistics to drive returns for our respective stakeholders.”

Sujoy Bose, Managing Director & CEO, National Investment and Infrastructure Fund Limited, said: “The deepening of our successful 4-year partnership with DP World is a testament to the attractive opportunities in the Indian ports and logistics sector and the strategic vision and ongoing reforms under the PM Gati Shakti programme.

The investment will enable NIIF’s domestic and international investors to have meaningful exposure in the sector through a unique and scalable platform with a significant presence across sea-based container terminals and land-based container logistics infrastructure.”

[1] Approximately US$300m. (Exchange rate of 1 USD = INR75)

[2] Twenty-foot equivalent unit.