Rivera –by John Snyder

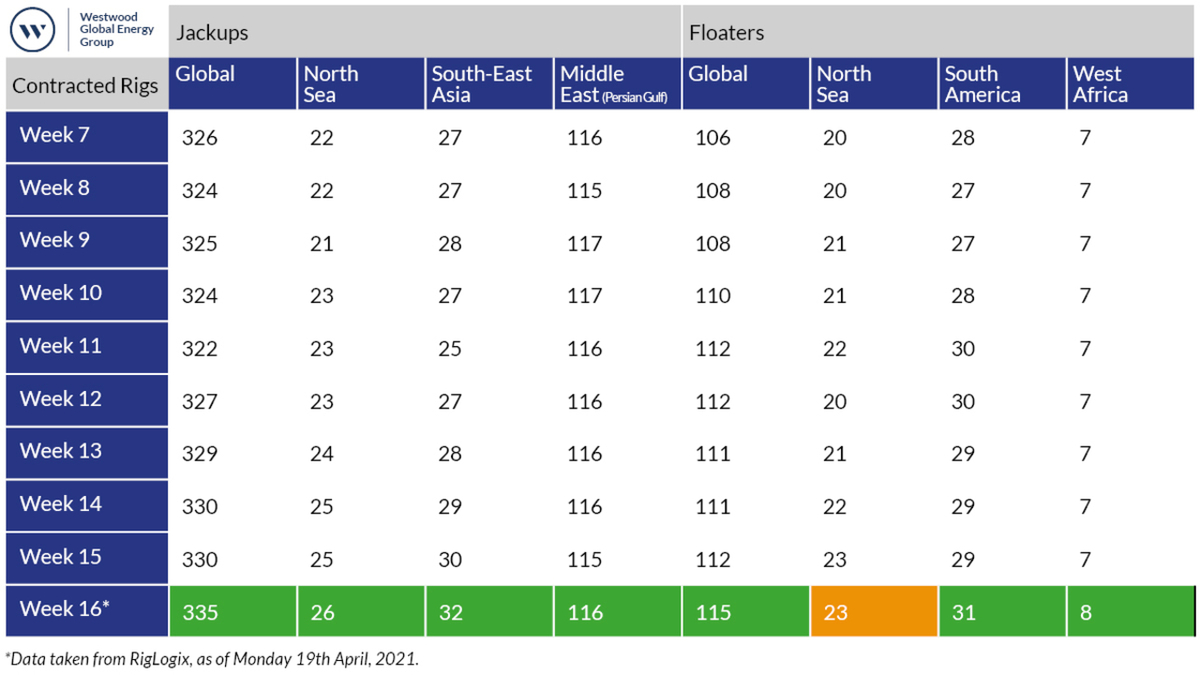

Global offshore jackup rigs climbed to 335 units with drilling activity up across the board, led by the North Sea and southeast Asia sectors with 26 and 32 active units, respectively. Floater activity, too, was up, reaching 115 actively drilling units, according to Westwood Global Energy’s RigLogix. Both figures were at their highest levels since May 2020.

Brent crude oil futures continued to trade at above US$60 per barrel. As of 6:51 AM EDT, Brent crude (ICE) June 2021 futures were US$65.97, down fractionally by US$0.60.

Rystad Energy oil markets analyst Louise Dickson noted some bearish developments weighing on oil prices. “A forecasted build of US crude inventories, a bill passed by a US House panel to challenge OPEC’s work to protect oil prices, and a continuous rise of Covid-19 infections in India and other countries weighed on prices,” said Ms Dickson.

She added that the “grim Covid-19 records in both deaths and infections are ringing alarm bells on trader floors” because “India is a huge consumer of oil and the possibility of consumption disruptions there amid a possible economy slowdown affects prices.

“However, India’s announcement not to resort to a full national lockdown and instead prioritise the economy is keeping losses moderate.”

The good news in the US is that more than 50% of the adult population in the US has received at least one jab of Covid-19 vaccine, with about 28M dose being delivered weekly. The Biden Administration is aiming to restore some semblance of normalcy to the lives of everyday Americans by 4 July – the US Independence Day holiday. If reached, this goal would be in time for the peak US travel season, suggesting an increase in demand for gasoline and jet fuel. Additionally, the anti-OPEC legislation appears to have little chance of passage into law.

Meanwhile, positive sentiment continued in the offshore drilling market in the Norwegian Sea. Harsh environment semi-submersible Transocean Norge will continue drilling in the Tyrihans field for Equinor, Total E&P Norge and Vår Energi, after finding resources estimated at between 3.0 and 4.2M standard cubic metres of recoverable oil equivalent, corresponding to 19M–26M barrels of oil equivalent.

Source: Westwood Global Energy/RigLogix

“It is encouraging to prove new resources that can extend the life of producing fields in the Norwegian Sea,” said Equinor senior vice president for exploration on the Norwegian continental shelf Nick Ashton.

Exploration well 6407/1-A-3 BH – which will be permanently plugged and abandoned – was drilled from subsea template A at Tyrihans North. The Tyrihans field is located in the middle of the Norwegian Sea, some 25 km southeast of the Åsgard field and 220 km northwest of Trondheim. The licensees consider the discovery commercial and intend to start production immediately.

Transocean Norge will drill the producer 6407/1-A-3 CH well on the Tyrihans field.

In other activity in Norway, Maersk Drilling reported securing an additional one-well contract for the low-emissions, hybrid, ultra-harsh environment jack-up rig Maersk Integrator with Aker BP. Valued at US$9.6M, the contract contains an option and will start in December 2021, continuing the rig’s current work with Aker BP.

ASCO Norge reported winning a contract as the preferred base supplier for INEOS Oil & Gas Norway’s first drilling operation on the Norwegian continental shelf.

ASCO Norge will be responsible for the delivery of base services for INEOS’ drilling operation of the Fat Canyon out of Kristiansund, where work is expected to begin in July.

The scope for the project includes complete logistics and supply base services, including loading/unloading of vessels, transport and customs clearance, storage, waste management, CCU services and management of equipment.

Drilling activity continued to strengthen in South America, with 31 floaters contracted. Maersk Drilling reported a contract with Karoon Energy for the semi-submersible rig Maersk Developer to perform well intervention on four wells at the Baúna field offshore Brazil. The contract is expected to commence in H1 2022, with a firm duration of 110 days. The value of the firm contract is US$34M, including rig modifications and a mobilisation fee. The contract contains options to add up to 150 days of drilling work at the Patola and Neon fields.

With the capability to drill in water of 3,000 m, 2009-built Maersk Developer is currently operating in Suriname.