-

By :Michelle Wiese Bockmann

Biofuels alongside operation efficiencies said to be largest contributors to emissions reductions in the short term

Hydrogen use is forecast to account for 16% of global maritime bunker demand by 2070.

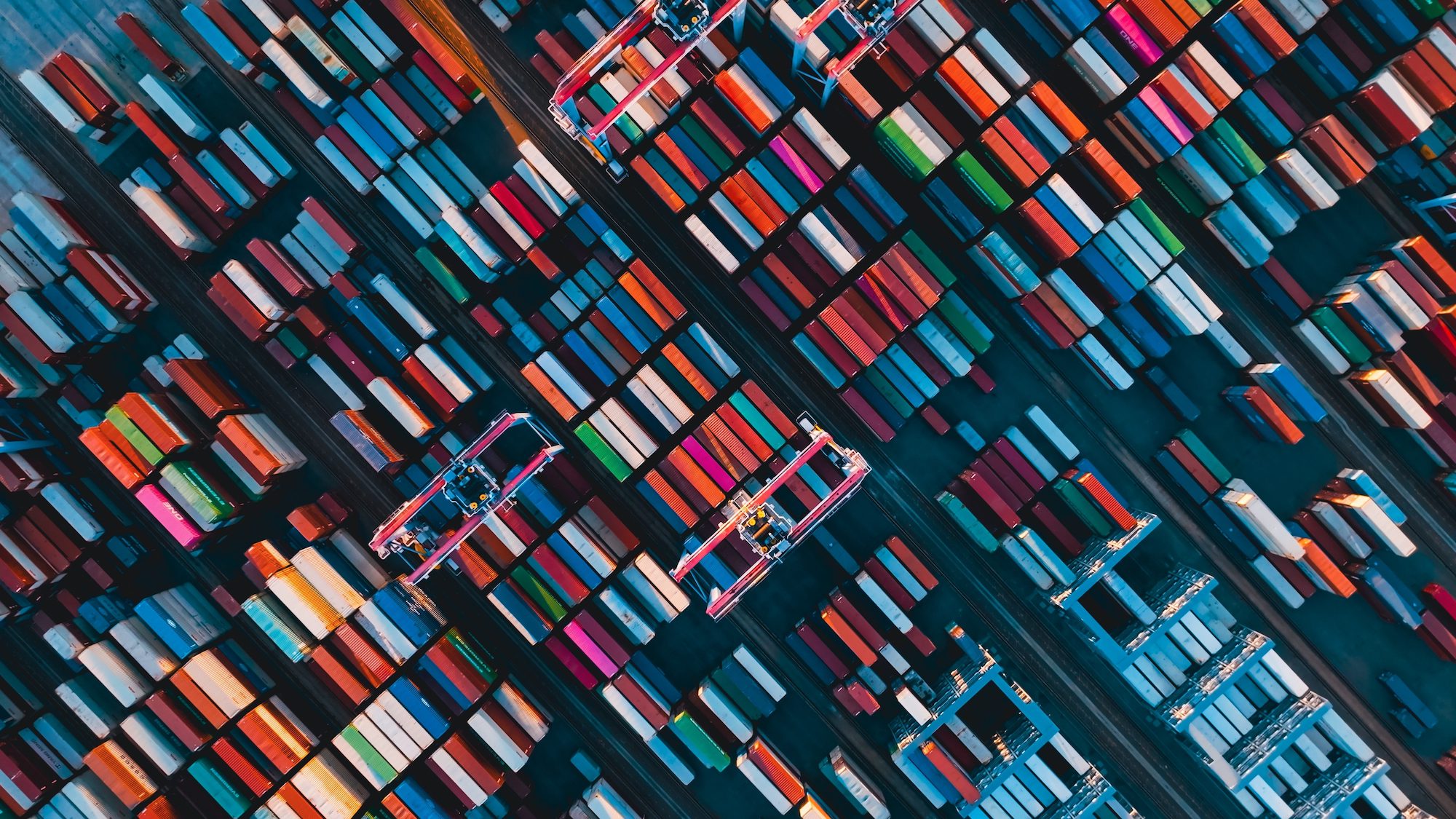

MARITIME shipping needs an additional $6trn in investment over the next 50 years to meet decarbonisation goals, the International Energy Agency says in its report Energy Technology Perspectives 2020.

The study assessed available technologies to meet zero-emission goals across the energy sectors, with a $21trn call on additional investment for global transport infrastructure encompassing shipping, aviation and freight.

Biofuels and operational energy efficiencies were expected to emerge within five years as the main, shorter-term contributors to emissions reductions for the global shipping sector.

Hydrocarbon- and ammonia-based technologies were nearly a decade away from commercial viability.

From 2025 biofuel oils would be blended with very low sulphur fuel oil in increasing amounts to displace conventional residual fuel, according to the report.

“Biofuels are the most promising fuel option for shipping in the short to medium term because they can be blended at gradually higher shares as a drop-in fuel into heavy fuel oil or diesel, which avoids the need for new vessels and fuel systems,” the report says.

“Biofuels could play a smaller role depending on the pace of progress of hydrogen and ammonia technologies, and on the speed of the scale up of second- and third-generation biofuels production capacity.

“However, the majority of vessels sold today run almost exclusively run on fossil fuels, and they will still be operating in 2050 unless regulations encouraging or mandating early retirements are put in place.”

In the medium term, blending with biofuels is forecast to increase from today’s “negligible” levels to reach 25m tonnes of oil equivalent by 2040, rising to 50m tonnes in 2060, accounting for one fifth of total energy use in shipping.

Biofuels production is estimated to scale up to 5m barrels per day over the next decade, from levels of 2m bpd in 2019, and used as an alternative to fossil fuels first for road vehicles and then for the maritime and aviation sectors.

“In the longer term, biomass-to-liquids (BTL) — an alternative technological pathway to making diesel substitutes — makes an increasing contribution in shipping energy use as BTL moves to large-scale production from about 2050, while ammonia and hydrogen come increasingly to the fore,” the IEA says.

“As ships using fossil fuels blended with some biofuel reach the end of their life from 2050 onwards, they are replaced by new vessels equipped with propulsion technologies compatible with ammonia and hydrogen, two technologies that become steadily more competitive after their first use on short and medium-distance trips from 2025, gradually replacing vessels using oil and, later, LNG, as they retire.

“Together they are used on over 60% of new vessels sold after 2060.”

Hydrogen use is forecast to account for 16% of global maritime bunker demand by 2070 and oil and gas for about one sixth of total shipping fuels.

Biofuels are the cheapest option for current decarbonisation measures according to the IEA, even though few companies are pursuing the technology. So-called ‘scaling up’ capacity is limited only by availability, with the technology favoured by the aviation sector.

The IEA’s roadmap for meeting international climate and energy goals, which it calls its “Sustainable Development Scenario”, assumes policies are implemented that will result in net zero emissions by 2070.

The IEA assumptions for its Sustainable Development Scenario are based on shipping emissions that are 70% lower than today’s levels by 2070 but yet to reach net zero emissions.

Shipping emission are forecast to peak “in the early 2020s” to the same level as in 2019, at 710m tonnes, the report said.

If decarbonisation policies remain unchanged, shipping emissions will rise by 50% from 2019 levels, to 1.1bn tonnes by 2050, stabilising through to 2070, according to the IEA.

“In maritime shipping, biofuels, ammonia and hydrogen meet more than 80% of fuel needs in 2070, using around 13% of the world’s hydrogen production,” the report says.

“Energy efficiency also makes a significant contribution. These changes require further tightening of efficiency targets and low-carbon fuel standards to close the price gap with fossil fuels and de-risk investment.”

The IEA highlights the dilemma facing global shipping as regulations to achieve lower greenhouse gas emissions with costly fuel alternatives clashed with the longer lifespan of vessels, which it said inhibited the uptake of new technologies.

Curbing fuel consumption by using operational energy efficiency technologies, including slow steaming, were obvious potentials the report said. Emissions-free ammonia and hydrogen fuels “look likely to be particularly important for long-range transoceanic travel”, according to the report.

It was technically feasible for short-distance ships to use less energy-dense fuels and switch to battery electric power.

Technology to switch to fuels such as ammonia and hydrogen was yet commercially available, the IEA says.

Two engine manufacturers expect to have ammonia-fuelled internal combustion engines ready by 2023.

Like this:

Like Loading...

مرتبط