Chinese not to oppose the consolidation was seen as a major step for the proposed acquisition of a controlling interest in DSME by Hyundai

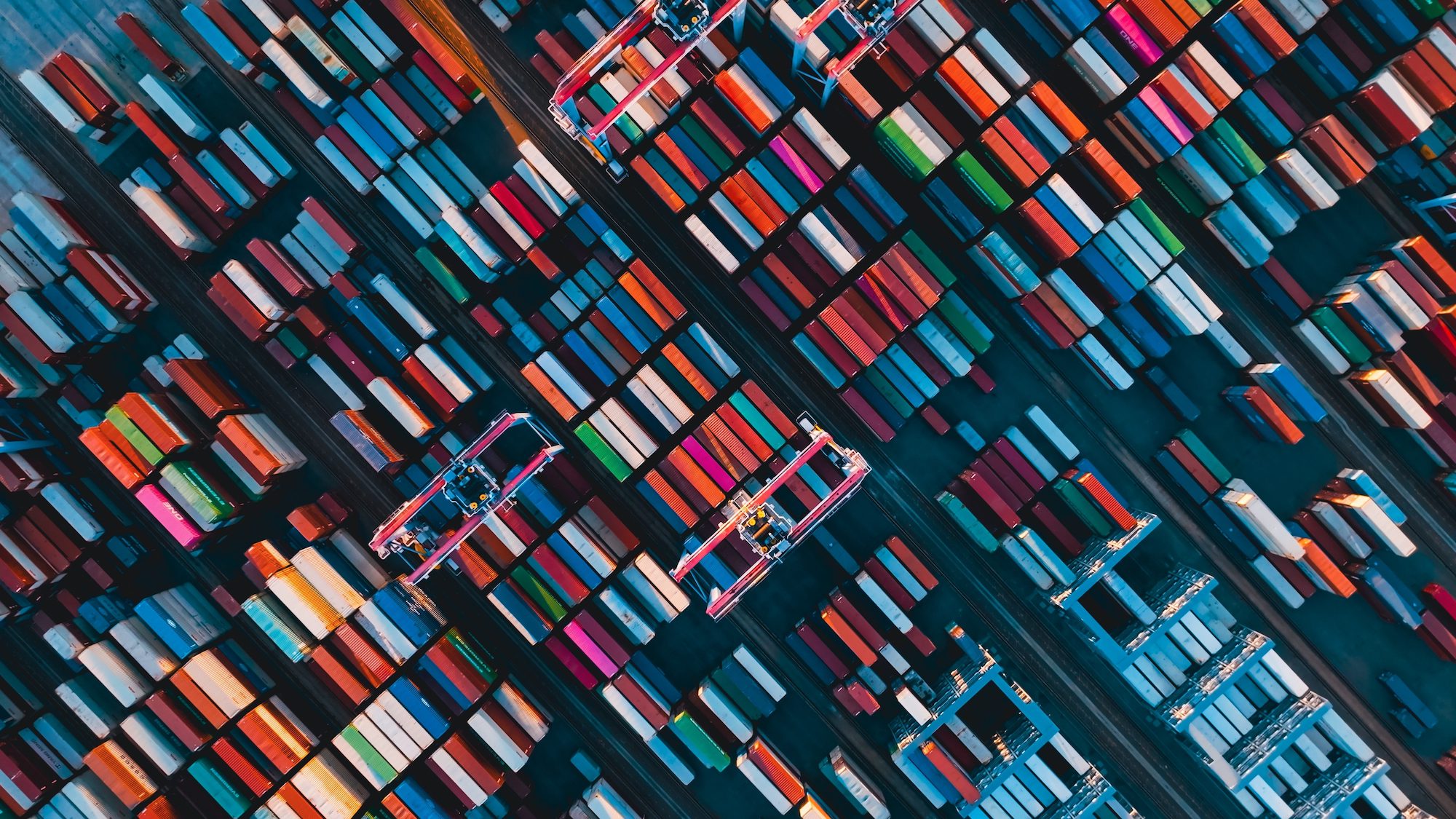

The continuing consolidation of the shipbuilding industry was given a boost with the announcement that Chinese regulators have granted approval to the proposed merger of South Korea’s two largest shipbuilders, Hyundai Heavy Industries and Daewoo Shipbuilding and Marine Engineering. The decision by the Chinese not to oppose the consolidation was seen as a major step for the proposed acquisition of a controlling interest in DSME by Hyundai.

Strategy to consolidate South Korea

Announced in March 2018, the strategy to consolidate South Korea’s leading shipbuilders was seen as a response to counter Chinese competition. The Chinese became the first of the major regulators after Singapore to approve the Korean merger, which still faces review by the European Union and a potential objection by the Japanese.

The EU has cited concerns that the combined Korean shipbuilders would hold a controlling position in the construction of LNG carriers as well as strong shares especially in the containership sector as well as dry bulk carriers. Under investigation is how the consolidation might impact shipowners as well the EU’s remaining shipbuilders who have fallen way behind the Chinese and Koreans in the number of ship construction orders.

Singapore and Kazakhstan have already granted approval

A spokesperson for Hyundai hailed the decision in the Korean media highlighting that the Chinese agreed that the proposed transaction would not hurt fair competition in the shipbuilding market. The company said that it is working hard to gain the approval of the remaining regulators. The companies have been facing the prospects of a long, drawn-out EU investigation, although some sources speculated that China’s approval might provide the companies leverage with the EU.

Korea’s Fair Trade Commission also needs to approve the merger. Korean media are speculating that the KFTC is holding back on its announcement seeking to coordinate with the EU. Singapore and Kazakhstan have already granted approval of the merger.

Despite strong declines in international orders, China continues to represent half of the global shipbuilding industry followed closely by the Koreans while Japanese shipyards

China’s approval of the merger comes at a time when the global shipbuilding industry has been hard hit by the impact of the pandemic driving new orders toward long-term lows. The Korean shipbuilders have been working hard to attract new orders and saw a flurry of large orders in the fall and late in 2020 prompting the Korean media to boast that the country’s shipbuilders had overtaken China with the highest volume of new orders for several months in a row.

China’s state shipbuilding association reported that through November 2020, the industry had experienced a better than 10 percent decline in orders for the year. Despite strong declines in international orders, China continues to represent half of the global shipbuilding industry followed closely by the Koreans while Japanese shipyards are a distant third in total new construction orders.

With shipbuilding being the largest industrial industry in South Korea, the government has been aggressive in supporting the shipbuilders.